Taxes. The word alone may induce cringing, nervous energy! Especially if you’re an independent contractor or freelance photographer. Once you go solo, you’ll have to fill out far more than that easy “1040 E-Z” form.

Have no fear, my dear. BP4U is here!

BP4U’s Tax Spreadsheets for Photographers

This little collection will save. your. life. It’ll squelch fears of IRS audits and help you sleep better at night, too! What BP4U’s Tax Spreadsheets for Photographers does for you:

A. Covers The Basics

Novice tax filer? This guide is your new BFF! It covers everything from basic tax terms to FAQs, step-by-step tutorials and number crunching tips.

B. Saves You Money

B. Saves You Money

Work out of your home? Use your car to get to photo shoots? Hire any assistants? Purchase guides (like this one) or other photography-related stuff (including cameras, printers, ink, etc.)? You can deduct all those expenses. We’ll tell you how much and how.

C. Keeps You Organized

All the forms included in this bundle will save you time and keep you organized. You can use them for your own reference or take them to your “tax guy.” Being organized is your number one shield against a tax audit (and, consequently, tax-related nightmares)!

This guide is perfect for hobbyist photographers, full time photogs who are just getting started and photographers who’ve been shooting for years. For more information on the Tax Spreadsheets for Photographers, click here.

What people are saying:

“I just want to tell you that your tax guide SAVED MY LIFE this tax season! I can’t thank you enough!!” -Shelly

“These forms saved me HOURS of time. Took the printed forms to my tax guy and I had everything more organized than I could have ever done on my own!” -Tiffany

- Expense, cost of goods sold, revenue, gross and net- what all this means and how much your business is ACTUALLY making

- Basic tax terms- what they mean and how they apply to you

- Glossary of frequently purchased expenses, and what category those expenses fall into.

- Deducting actual vehicle costs vs mileage- which benefits you more

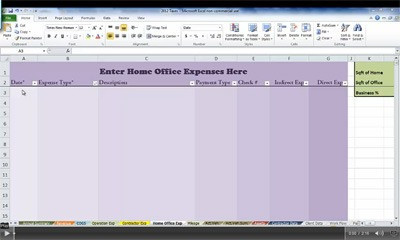

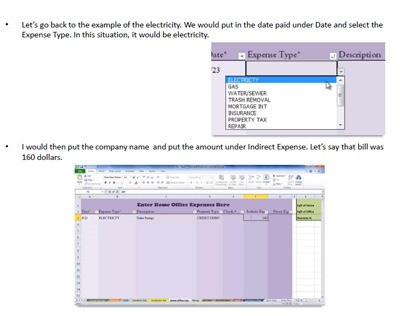

- Home office deductions- what can you write off, and how much of it

- Do you have bag-holders/assistants/associates? What information you need from them, and what to do with it

- What your business is actually making you and how to save at tax time

- Step by step tutorials on how to actually use the forms

- Keep completely organized for your taxes all the way up until 2020, no update required

- We talk about all of this, plus more.